The sales of Sears dropped from $41 billion to $15 billion, Sears closed a several amount of stores, Sears has a lot of debt, etc.

These are some of the facts that Sears is facing at the moment, which is the reason in this document it is going to be analyzed the bankruptcy of Sears.

To start analyzing it is important to understand the following information:

As you can see the Net Income in the last 4 years has been negative, this meaning that the Expenses are higher than the Revenue that Sears Holdings are producing.

In the balance sheet the total Equity is also negative, showing that their assets are far much less than the liabilities.

Some of the reasons that have been contributing to the bankruptcy of Sears are: the demographic changes, the generation that used to buy in SEARS have grown up and are not the big part of the population; the ages from 16 to 35 are now the most important customers and are not paying attention to SEARS and their products, another reason is the technology, the users in the US are now buying online, this creates the E-commerce, which creates competition. 40 percent of internet users in the United States stated that they purchased items online at several times per month, and 20 percent said they bought items or services online on a weekly basis.

Another important fact is that Sears make a lot of discounts which makes Sears not interesting for the customers anymore.

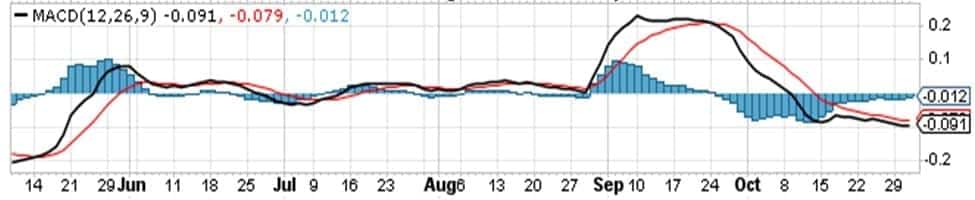

Looking at the MACD chart of Sears, we can see that the black line is under the red line, which tell us that is in negative numbers… also we can see that Sears has been playing a bearish period, which means that its numbers have been going down.

In the MACD chart, the blue histogram show us the performance of the people in relation with their decision of stop buying Sears shares, and as it is going down, the people does not want anymore to buy them.

In this chart we can see that since 2014 Sears has been facing a strong bankruptcy, it is all red and going down, every year more and more. But we can also see that starting 2019 Sears is going to be with a few green numbers, but those cannot be compared with all of their losses.

In September 2018, SHLD share price fell below a dollar, and it further slid to trading close to 50 cents on October 10, 2018. Not only is that a huge drop from the start of the year when the share price was close to $4 a share, but the company now also runs the risk of getting delisted from the Nasdaq.

In the last few months Sears announced an alliance with AMAZON, where customers can select the tires that they like and can locate the nearest Sears store and make an online appointment for installation and balancing service.

In a first stage, the service will be launched in eight cities in the United States: Atlanta, Chicago, Dallas, Los Angeles, Miami, New York, San Francisco and Washington, DC; this announcement made the stock to lose less in comparison to the previous months.

REFERENCES:

Nathan Bomey. (2018). Sears expands tire services deal with Amazon. 13/11/2018, de USA TODAY Sitio web: https://www.usatoday.com/story/money/cars/2018/06/12/sears-amazon-tires/693723002/

Shoshanna Delventhal . (15/10/2018). Who Killed Sears? 50 Years on the Road to Ruin. 13/11/2018, de Investopedia Sitio web: https://www.investopedia.com/news/downfall-of-sears/

Chris Isidore. (2018). Sears, the store that changed America, declares bankruptcy. 2018, de CNN Business Sitio web: https://edition.cnn.com/2018/10/15/business/sears-bankruptcy/index.html

Sears Holdings. (2018). SHLDQ Balance Sheet. 13/11/2018, de Investing Sitio web: https://www.investing.com/equities/sears-hldgs-corp-balance-sheet

StockCharts. (13/11/2018). MACD. 13/11/2018, de Stock Charts Sitio web: https://stockcharts.com/h-sc/ui?s=SHLDQ