The Capital Asset Pricing Model was initially developed by the economist Harry Markowitz, who established portfolio theory as one of the main theory of financial economics, in order to find the mean variance of an efficient portfolio he proposed a one factor model known as the CAPM Model (Naveed, & Syed Umar Farooq. 2018). The Capital Asset Pricing Model inspired by Markowitz (1962) proposes that the expected return on a given asset above the risk-free rate should be proportional to its non-diversifiable risk or market risk (measured by β), under conditions of market equilibrium; the CAPM Model predicts that the market portfolio consists of all variable assets, each having a weight proportional to its market value and the market risk factor (Falcão Noda, R., Martelanc, R., & Kazuo Kayo, E. 2016). The CAPM is defined as a static, linear, monofactorial model which assumes that the opportunity cost of equity is determined by the level of exposure of the firm to the financial market risk (measured by the beta coefficient, specific for a company); the assumption at the base of the model is that the cost of equity is influenced exclusively by risk factors which co-vary with the sources of systematic risk, therefore not by the idiosyncratic risks of each single company. Despite the reasons of the success of the Capital Asset Pricing Model (simplicity and stability of results over time), the ability of the CAPM to explain the returns of portfolios of homogeneous-beta equity securities is quite low (Laghi, E., & Di Marcantonio, M. 2016).

According to Jagannathan and Wang (1996), general class of Capital Asset Pricing Models fail when facing empirical evidence because of two reasons: the CAPM holds in a conditional sense only, the stochastic discount factor is linear as stated in the CAPM; but the coefficients of the model are time varying. The static specification of market premium fails to take into account the effect of time-varying investment opportunities in the calculation of asset risk (betas of firms with relatively higher leverage rise during recessions: firms with different types of assets will be affected by the business cycle in a different way and to a different extent), another reason attributed to the failure of general class of CAPM is that the return on the value-weighted portfolio of all stocks is a bad proxy-to-wealth return (Demir, E., Fung, K. W. T., & Lu, Z. 2016).

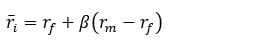

On the other hand, the Capital Asset Pricing Model assumes that the opportunity cost of equity of a given company is equal to the sum of the price of time (risk free rate) and additive term that reflects the price of systematic risk (Laghi, E., & Di Marcantonio, M. 2016). The Capital Asset Pricing Model formula can be expressed as:

Where:

is the price of time (risk free rate)

is the expected market return

β is the market risk

Bibliography

Laghi, E., & Di Marcantonio, M. (2016). Beyond CAPM: estimating the cost of equity considering idiosyncratic risks. Quantitative Finance, 16(8), 1273–1296. Retrieved from http://ezproxy.upaep.mx:2062/login.aspx?direct=true&db=eoah&AN=39516491&lang=es&site=ehost-live

Demir, E., Fung, K. W. T., & Lu, Z. (2016). Capital Asset Pricing Model and Stochastic Volatility: A Case Study of India. Emerging Markets Finance & Trade, 52(1), 52–65. https://ezproxy.upaep.mx:2074/10.1080/1540496X.2015.1062302

Naveed, & Syed Umar Farooq. (2018). Performance Evaluation of Pakistani Mutual Funds: Through CAPM model. Abasyn University Journal of Social Sciences, 1–7. Retrieved from http://ezproxy.upaep.mx:2062/login.aspx?direct=true&db=asn&AN=131549391&lang=es&site=ehost-live

Falcão Noda, R., Martelanc, R., & Kazuo Kayo, E. (2016). The Earnings/Price Risk Factor in Capital Asset Pricing Models. Revista Contabilidade & Finanças – USP, 27(70), 67–79. https://ezproxy.upaep.mx:2074/10.1590/1808-057×201412060

Ahn, S. C., Horenstein, A. R., & Wang, N. (2018). Beta Matrix and Common Factors in Stock Returns. Journal of Financial & Quantitative Analysis, 53(3), 1417–1440. https://ezproxy.upaep.mx:2074/10.1017/S0022109017001120

Rathnasekara, R. D. (2017). Testing Stock Market Efficiency and the Asset Pricing Model: Some Evidence from Sri Lanka. Journal of Developing Areas, 51(4), 317–330. Retrieved from http://ezproxy.upaep.mx:2062/login.aspx?direct=true&db=bth&AN=123825707&lang=es&site=ehost-live